Top 5 Funds Investing in Play and Earn Projects

Author: Hawk Live LLC

Last updated:

Play-to-earn projects have the potential to revolutionize the gaming industry and change the way we think about video games. These projects offer a unique opportunity for players to earn real-world rewards simply by playing the games they love.

Many people spend countless hours playing games, but rarely see any financial benefit from it. With play-to-earn projects, players can earn real money or valuable in-game items simply by playing the games they enjoy. This can be especially lucrative for those who are skilled at a particular game and are able to consistently perform well.

Another exciting perspective of play and earn projects is the potential for long-term returns on investment. Some of these projects use blockchain technology, which means that the items or assets earned through gameplay can potentially increase in value over time. This can make play-to-earn projects a smart investment for those looking to grow their wealth through gaming.

This is the reason why not only independent investors, but also big investment funds managing billions of dollars invest their clients' money in play to earn projects.

Which funds invest in P2E?

Andreessen Horowitz

Andreessen Horowitz (also known as "a16z") is a venture capital firm that was founded in 2009 by Marc Andreessen and Ben Horowitz. The firm has a reputation for backing successful technology companies, and has invested in a wide range of industries, including software, consumer internet, mobile, gaming, GameFi projects and more.

One of the key differentiators of Andreessen Horowitz is its approach to investing. The firm takes a long-term view and focuses on supporting the growth of its portfolio companies.

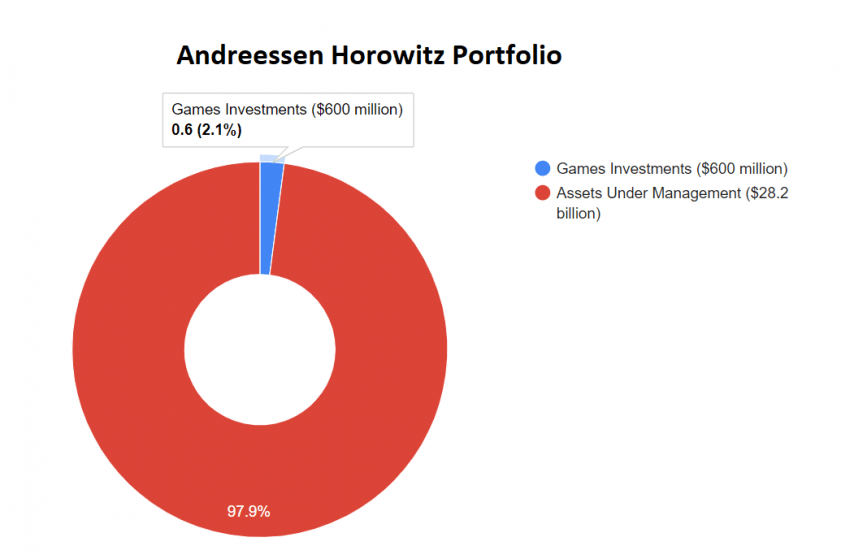

How much has Andreessen Horowitz invested in the play-to-earn segment?

In 2022 the firm launched a new $600 million fund that is focused on investing in opportunities within the blockchain gaming industry, including the play-to-earn segment. This new fund is expected to bring a significant amount of dedicated capital, as well as a new internal structure, to help identify and pursue investment opportunities within the gaming industry. Some of the notable projects that Andreessen Horowitz has invested in include:

- Azra Games (Project Arcanas) - $15 million

- Battlebound (First Arrivals, Turtle Troop, Hoverboards) - $4.8 million

- Bonfire Games - $25 million

- Carbonated Games - $8.5 million

Binance Labs

Binance Labs is the venture arm of Binance, a cryptocurrency exchange that was founded in 2017. It focuses on incubating, investing in, and building blockchain and cryptocurrency projects. The goal of Binance Labs is to support the development of the blockchain ecosystem and to drive the adoption of cryptocurrency and blockchain technology.

Binance Labs has invested in a number of blockchain and cryptocurrency projects, including decentralized exchanges, stablecoins, and infrastructure projects. It has also launched a number of incubator programs to support the development of early-stage projects.

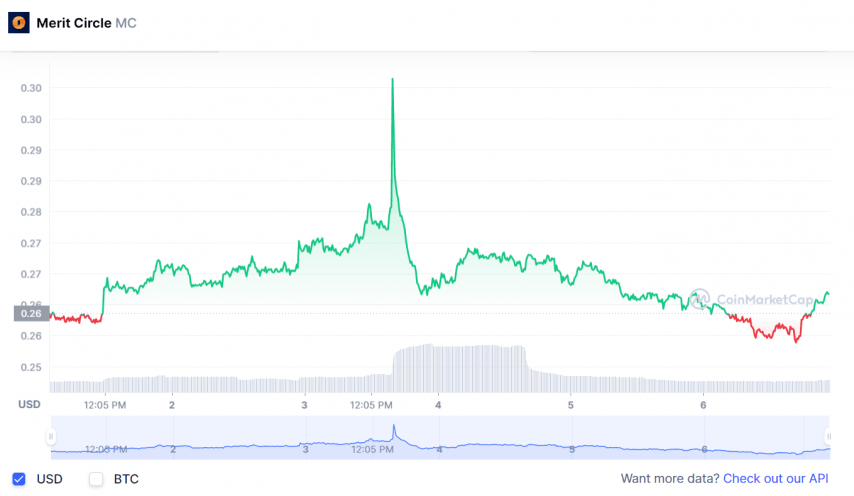

In 2022, Binance Labs invested in gaming DAO Merit Circle with the goal to expand the play-to-earn industry.

Some of the companies developing play-to-earn games Binance Labs invested in are:

- Sky Mavis (Axie Infinity) - $150 million

- Mythical Games (Blankos Block Party) - $150 million

- Ultimate Champions - $4 million

- GAMEE $1.5 million

- In December, 2022, the company amassed 2,100% returns on investments since inception

Animoca Brands

Animoca Brands is a well-respected company in the digital entertainment, blockchain, Defi and gamification industries. It has received recognition for its growth and innovation, including being named a Deloitte Tech Fast winner and being included on the Financial Times' list of High Growth Companies in the Asia-Pacific region for 2021.

The company is committed to advancing digital property rights and helping to build the open metaverse. It has a diverse portfolio of products, including its own tokens (REVV and SAND), original games, and products based on popular intellectual properties. Animoca Brands has many subsidiaries, including:

- The Sandbox

- Blowfish Studios

- Quidd, GAMEE, and others

In addition to its own products, the company has invested in over 380 other organizations, including

- Sky Mavis (Axie Infinity) - $150 million

- Harmony - $250 thousand

- Alien Worlds $2 million

- Star Atlas - $3 million

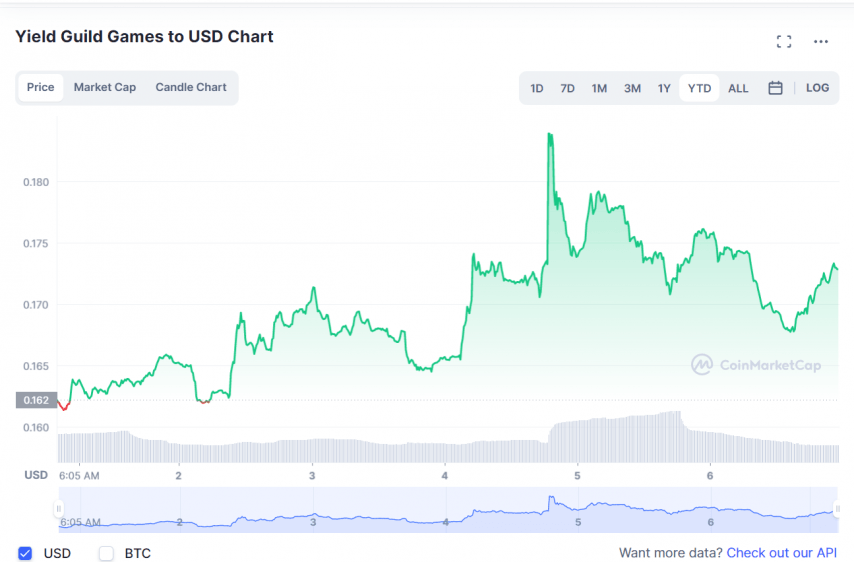

- Yield Guild Games - $1.325 million

On January 5, Animoca Brands announced it is trying to raise around $1 billion in the current quarter for a new investment fund focused on Web3 and the metaverse. However, this goal represents a significant reduction from its original plans, likely due to the current downturn in the cryptocurrency market.

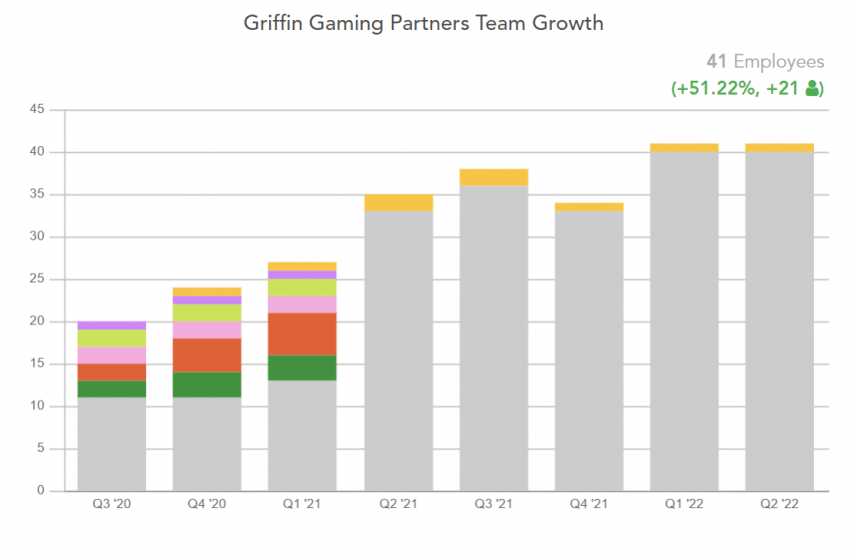

Griffin Gaming Partners

Griffin Gaming Partners is a venture capital fund with more than $1 billion in assets under management. It is focused specifically on the gaming industry and is one of the largest funds of its kind in the world. The company was founded by Peter Levin, Phil Sanderson, and Nick Tuosto, and has a reputation for being supportive of founders, having a strong passion for the gaming industry, and bringing a wealth of investment, advisory, and operational experience to the table.

Spyke Games - $55 million;

WinZO - $65 million;

Players' Lounge - $8.5 million euro.

FTX Ventures

According to U.S. authorities, FTX, a company founded by Sam Bankman-Fried in 2019, used customer funds for political donations, real estate purchases, and investments in other companies. In November, FTX filed for bankruptcy due to its inability to fulfill around $8 billion in customer withdrawal requests. It is reported that the company invested approximately $3.2 billion in 250 different cryptocurrency projects in exchange for tokens or token IOUs, including well-known projects such as Polygon, Near, and Lido, as well as around 200 lesser-known projects.

Regarding the gaming industry, including pay-to-earn segment, FTX Ventures has invested in the following projects:

TripleDot - $50 million;

JustWontDie Ltd - $7,5 million;

Mythical Games - $4 million;

Soba Studios Good Game Inc - $3 million;

Swoop - $1 million.

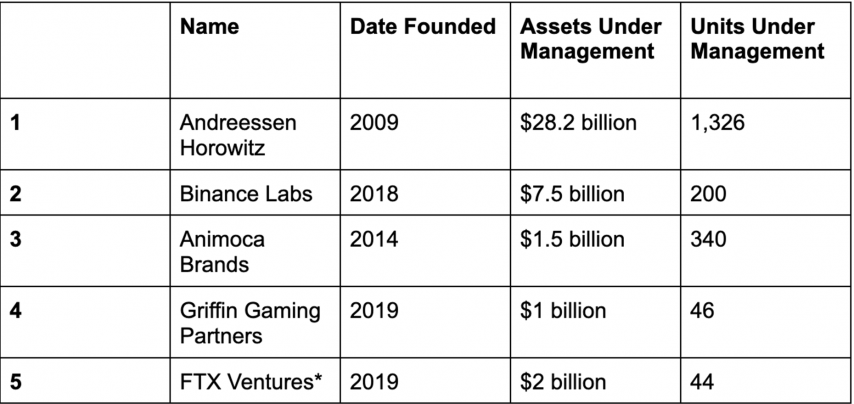

Top 5 Funds Investing in Play and Earn Projects - Comparison Table

*The FTX Ventures website is unavailable. The company is experiencing an unpredictable future.

Conclusion

Overall, play-to-earn projects have the potential to change the way we think about video games and the role they play in our lives. These projects offer a fun and rewarding way for gamers to monetize their hobby and potentially earn long-term returns on their investment. The future of play-to-earn projects looks bright and we can't wait to see what the future holds!