How much do developers earn from Play to Earn games

Author: Hawk Live LLC

Last updated:

In the first and second quarters of 2022, $2.5 billion was invested in blockchain games in general and Play to Earn in particular, despite the emerging crypto winter on the market. The “play to earn” business model can seriously compete with the traditional game industry even before it reaches its full potential.

Despite the fact that the user, endowed with the ability to invest and increase, has become the center of P2E games, it would be a mistake to assume that developers do not receive anything from this.

How developers actually make money

Most Play to Earn games are developed and launched following the traditional DeFi and GameFi model. Attracting investments begins at an early stage, on average 1-2 years before a full-fledged release, when the team has only a business project in its hands. Sources of financing are venture funds. At the expense of the funds received, the organizers recruit a team and initiate development.

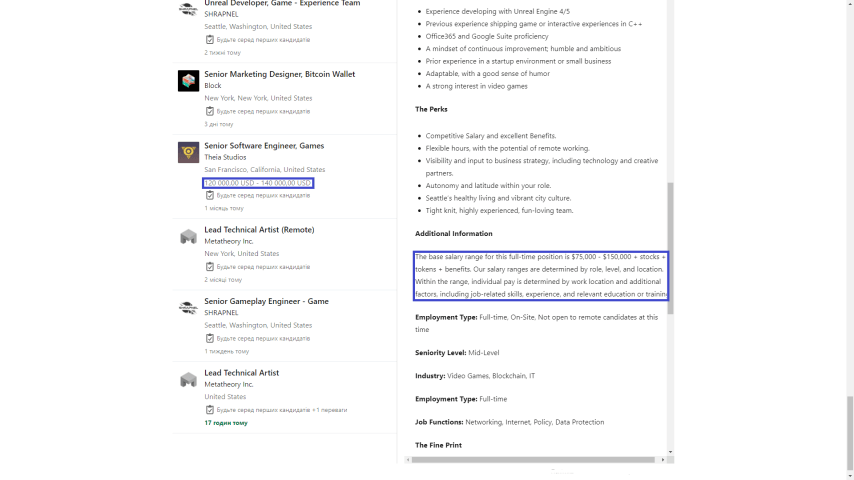

An idea of the amounts of money concentrated in this sector can be obtained from the level of salaries of developers hired on the staff - game designers, testers, blockchain experts and art directors. Here’s what we were able to find in LinkedIn jobs in early 2023:

Job openings at GameFi in the USA, annual salaries

Some proposals claim that the fixed salary is supplemented with tokens:

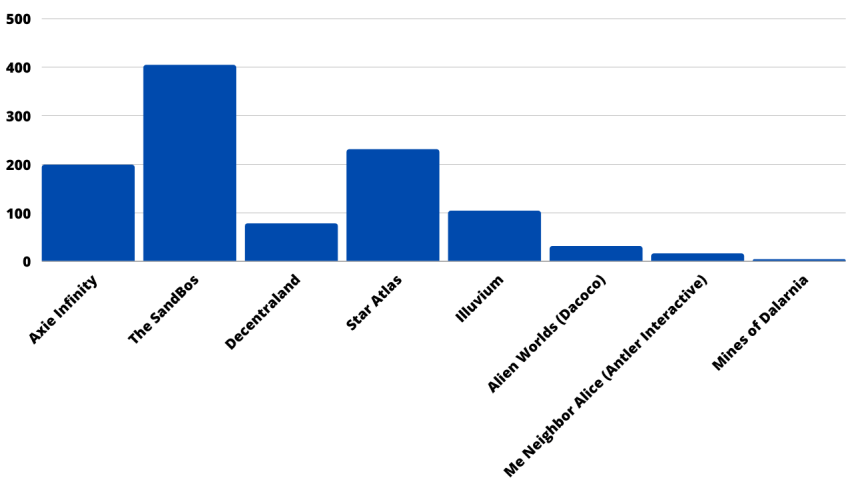

We used public data from the PitchBook SaaS platform to get an idea of the size of the average development team for the most famous P2E projects. The difference was impressive - from 3 to 404 people.

Number of employees in blockchain game teams

The average total supply of tokens for these projects was 2.06 billion. Assuming that the average team of 130 people takes 15% of the tokens and evenly distributes them among the participants, everyone receives about 238 thousand tokens. How valuable these tokens turn out to be depends on the popularity of the game they created. If users are interested in gameplay, and the NFTs added to the universe look attractive from an investment point of view, the audience will begin to actively use utility tokens - then their price will grow, and such a bonus to the basic salary may be more significant than the salary itself.

To encourage users to buy tokens, developers introduce specific mechanisms into the game related to payment for in-game items and transaction costs.

Pay to Play

Pay to Play is a classic business model for standard desktop, console and mobile games. To access the game, the user must first purchase it from an online store or external media.

Formally, Play to Earn does not belong to the Pay to Play category, because most of the games on the market can be installed for free or launched from a browser. In fact, in some of them you have to pay to become part of the gameplay. This may be the purchase of a base character, land or other game property, which is subsequently monetized or resold at a higher price.

This is how Decentraland works, a metaverse game in which digital land plots are bought and sold - they can also be rented to other players or get rented. In Sandbox, you need to pay for creating or using someone else’s site (depending on the intentions of the author) and customizing avatars. All transactions use internal project tokens.

Additional features and transaction costs

In addition to buying and selling objects on the internal marketplace, tokens can be used for other operations:

- Voting within the system (for example, for the introduction of updates);

- Access to advanced features for content creation;

- Obtaining passive income through staking in Proof-of-Stake blockchains.

Almost all transactions in the network are subject to a commission, which is distributed among the validators. This ensures earnings for all network participants and the constant use of tokens, maintaining their value in the market and allowing developers to earn.

In some projects, commission fees may be partially returned to the team. In one of the interviews, a representative of the Danish developer company Bright Star Studios, which uses blockchain in its projects, said that they have implemented a similar technology using Ethereum smart contracts. Now when users buy skins in their games, Bright Star Studios profits directly.

Tokenomics of Play to Earn projects: how much developers earn on P2E

The token distribution model varies greatly from project to project. Most often, tokenomics takes into account:

- Private and public sales, launchpads, Seed sale and other investment stages;

- Marketing;

- Funds;

- Project reserves;

- Distributions in the community, Bounty and Airdrop;

- Reward for the team.

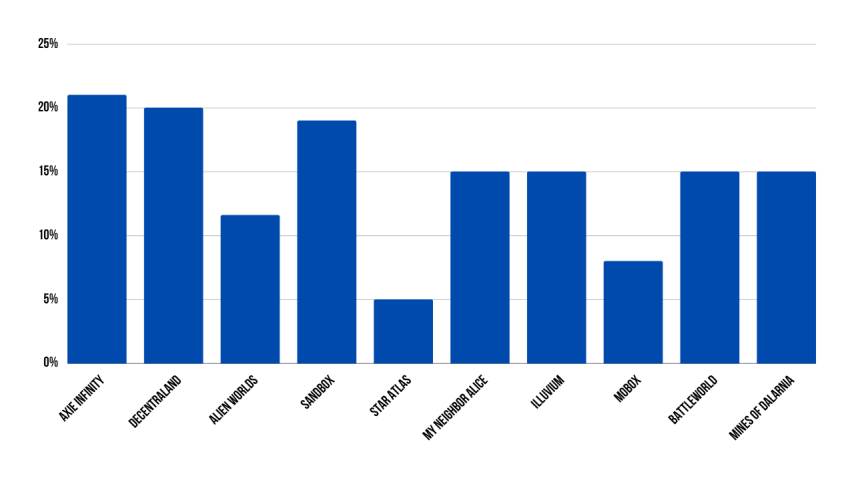

We selected 10 Play to Earn projects with the largest capitalization according to CoinMarketCap and analyzed their tokenomics. At the token distribution stage, the teams of these startups took from 5% (Star Atlas) to 21% (Axie Infinity) of the offer. The average approximate value is 14.5%:

Share of remuneration of popular blockchain games’ teams

The market capitalization of the Play to Earn sector in January 2023 was $4,176,890,142 (CoinMarketCap). We can simulate a theoretical situation in which all P2E developers received 14.5% of the total supply of immediately unlocked tokens and now own all of them. In this case, at the moment, the share of all NFT teams would be estimated at about $605,649,070 only at the expense of already unlocked tokens received at the distribution stage, excluding earnings from commissions.

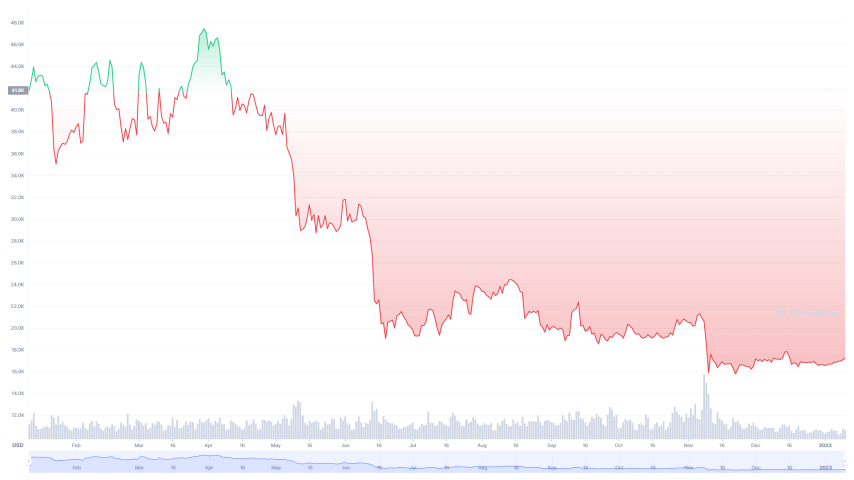

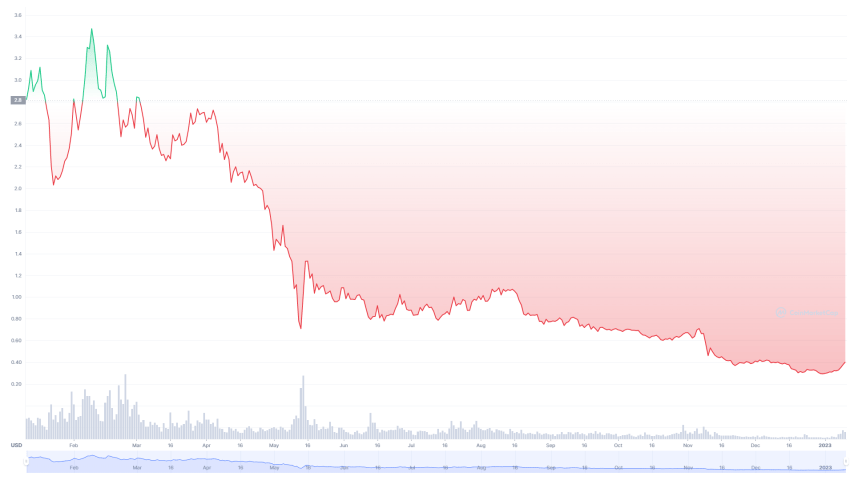

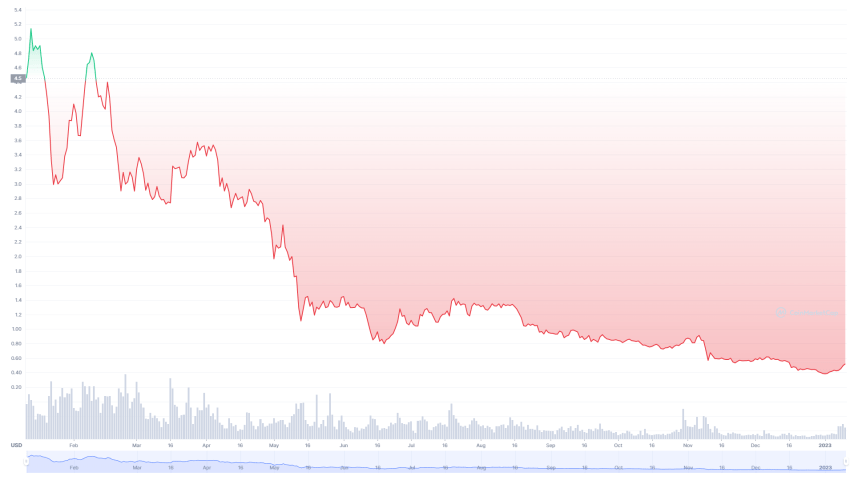

In 2022, the market entered a period of crisis, and most of the blockchain game coins picked up the Bitcoin downtrend:

Bitcoin

Decentraland

The Sandbox

This factor should be taken into account when assessing the income of P2E teams. For comparison, 2021 turned out to be much more profitable for developers and players themselves - then the market capitalization of Play to Earn was about $9 billion, of which about $1.3 billion would have come from project teams.

Even if the developers of future blockchain games remain in the average range of 14.5% of the supply, their profits are likely to increase in the future. Such a conclusion can be drawn by studying the Business Research Insights research “GameFi Market Size, Share, Growth and Industry Analysis <...> to 2028”, in which the authors suggest that by 2028 the market will have grown to $38 billion.

Of course, it should be understood that these figures are very arbitrary. In fact, the income of developers is affected not only by the percentage of their remuneration, but also by other factors:

- Blocking of tokens, present in most projects;

- The changing rate of assets;

- Using or holding unlocked coins and others.

To understand how much developers actually earn from P2E, you need to look at examples with more specific parameters.

How much did the Axie Infinity team earn?

The transparency of the documentation and the availability of information on the financing of the blockchain game Axie Infinity will make it possible to calculate the developers' income for a large project as approximately as possible.

The native Axie Infinity token is in the TOP of the CoinMarketCap capitalization rating and is also the most expensive Play to Earn and Play and Earn token in the industry.

An alpha version of the game was released by Sky Mavis in December, 2019. Developers have introduced two tokens into the ecosystem: the more popular Axie Infinity Shards (AXS) and Smooth Love Potion (SLP), formerly known as Small Love Potion. Each token has its own function: the first plays the role of a utility and is used for voting, staking and paying fees. The second is an in-game coin needed to buy, sell, and cross playable characters.

The development of the project started in 2017, and already in February 2018 Sky Mavis attracted 900 ETH or about $750,000 at that rate to the project by selling AXS and NFT tokens of in-game sites. In January, 2019, the second round of funding took place, bringing the team another 3,200 ETH.

This was followed by three more rounds of fundraising: in November, 2019, May and October, 2021, through which Sky Mavis received $159 million. The public sale in 2020, which allocated 11% of the total supply of tokens, raised $2.97 million.

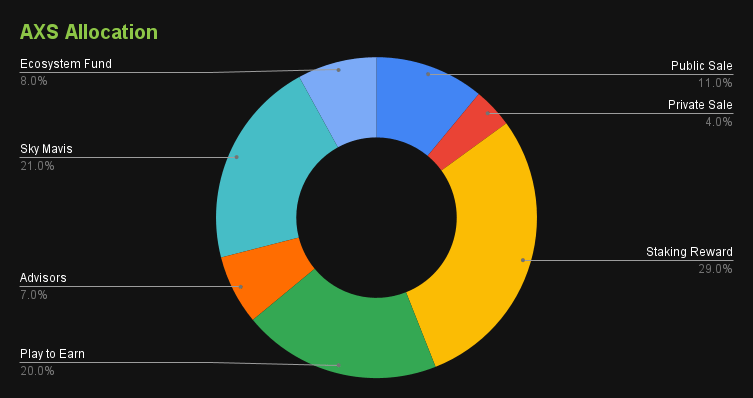

And now we should say a few words about the tokenomics of the project. The total supply of AXS Axie Infinity was 270 million tokens distributed as follows:

Source: Coingecko

The Sky Mavis development team received 11% or 56,700,000 AXS: at the time of the historical maximum, when the token reached $165.37 (2021), their share was estimated at $9.3 billion, or $426.9 million at the current rate of $7.5 at the beginning of 2023.

As of early 2023, only 37% of the total supply of Axie Infinity is in circulation. Tokens allocated to developers have been partially locked up and will be gradually unlocked until mid-2025 or 54 months after the public auction.

On the first day of public trading, November, 4, 2020, Sky Mavis unlocked 10,800,000 AXS tokens, or $1.08 million at a rate of $0.1. Then another 5,737,500 AXS in November, 2021 ($812.4 million at the rate of $141.6), and 5,737,500 AXS each in May and December, 2022 ($167.01 million and $38.4 million, respectively). Assuming that the team members cashed out their tokens immediately at the current rate at the time of unlocking, in total over the past three years they have earned about $1.018 billion. In the future, the team expects five more unlocks that will occur every six months.

We do not know how things are with the distribution of finances within the team and how much each member receives. The company now has 198 employees, according to PitchBook, and regardless of how the profits were divided among them, the company’s earnings are impressive.

Conclusions

The GameFi sector is one of the fastest growing in the market of cryptocurrencies. In addition to the abovesaid, there are even more optimistic forecasts regarding its trends: for example, the analytical company Markets & Markets in its latest report suggested that Play and Earn will grow by 70.3% over the next four years and by 2027 the market size will have reached $ 65.7 billion.

Now, while digital assets and Bitcoin are in a protracted bearish trend, P2E profitability has decreased somewhat for both players and developers. But the situation is likely to change as the industry thaws.