eSports for $13 billion: bubble, breakout, or promising new market?

Author: Hawk Live LLC

Last updated:

While soccer is losing viewers, Coca-Cola, Jordan and the Chinese government are investing in cybersports. Over two decades, cybersports has evolved from an enthusiast's pastime to a popular industry generating multimillion-dollar revenues. The rapid growth of the audience causes a corresponding increase in profits for all participants in this economic segment. This is attracting major market players, from Intel and Coca-Cola to BMW and Barclays.

By 2025, it's safe to say: cybersports has evolved into a full-fledged economic ecosystem comparable in scale to traditional sports. In this article, we take a look at how the cybersports economy has evolved from its inception to the present day.

From room LANs to billions: how cybersports became a superbusiness

The first major tournaments on Dota and CS were held back in the 2000s, but then the industry brought almost no income: the interest of the general audience was weak, and business did not see the sense in investments. Today, the growth of the cybersport economy can be traced according to the data of leading analytical portals.

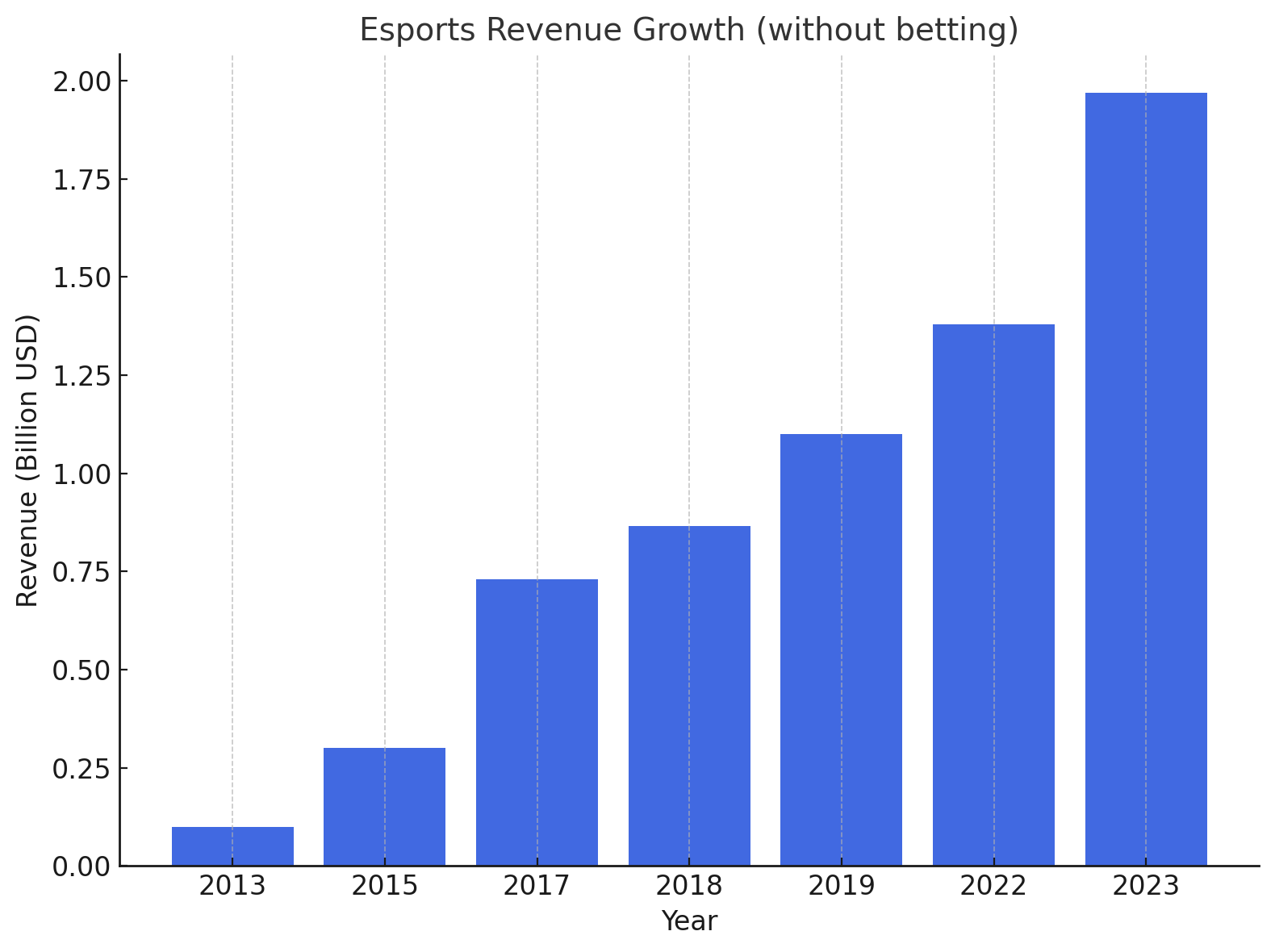

According to British eSports estimates, the entire market in 2013 did not exceed $100 million. The first noticeable increase in investment was recorded in 2015, and by 2017 the volume of the cybersports economy was already estimated at $730 million.

According to ESPN, the market grew to $865 million in 2018, and in 2019, revenue exceeded $1 billion ($1.1 billion) for the first time. According to VentureBeat, in 2022, revenues totaled $1.38 billion, and according to GlobeNewsWire, the market reached $1.97 billion in 2023.

Despite its impressive growth, the industry is still relatively small in terms of absolute revenue: about $2 billion in 2023. For comparison, Netflix's revenue for one quarter of 2024 amounted to $8-9 billion. However, the growth rate of cybersports is much higher. Experts note that the model of its economy formation is similar to the media industry and professional sports, but with a clear digital bias.

Interesting fact: “Betting revenue in eSports is already 6 times higher than streaming revenue. That's a red flag for platforms.”

What makes money: betting, streaming, merch and broadcasts

Sponsors and partnerships - the gold of cybersport

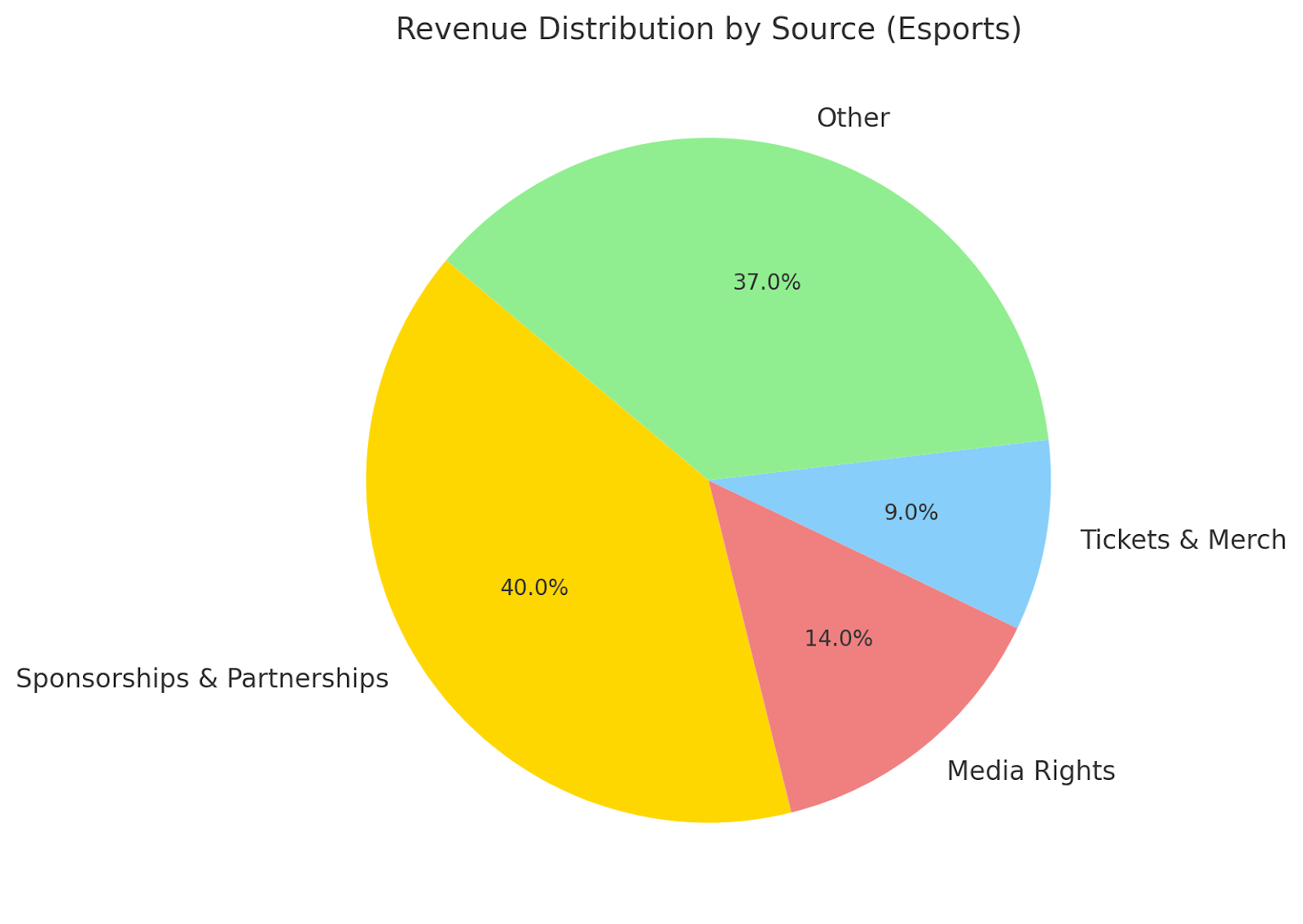

Sponsorship contracts and partnerships remain the main source of income. According to Maximize Market Research, they account for 38-40% of all revenues.

Thus, in 2021, sponsorship agreements brought the industry $641 million - more than all other sources combined. These include contracts with technology brands, apparel, equipment manufacturers, and food manufacturers. The companies pay for logo placement, joint promotions and image-driven advertising campaigns.

Broadcast rights are a growing source

In second place are media rights at 14% of revenue. This is revenue from the sale of broadcast rights to TV channels and streaming platforms, as well as on-air advertising. In 2021, this segment brought in $192 million. According to forecasts, the share of media rights will grow as the audience grows.

Live emotions bring profit

The third place is occupied by ticket and souvenir sales during tournaments - about 9% of revenue.

Also notable are revenues from team merch, virtual merchandise and subscriptions - collectively tens of millions of dollars.

How betting affects the volume of cybersports revenue

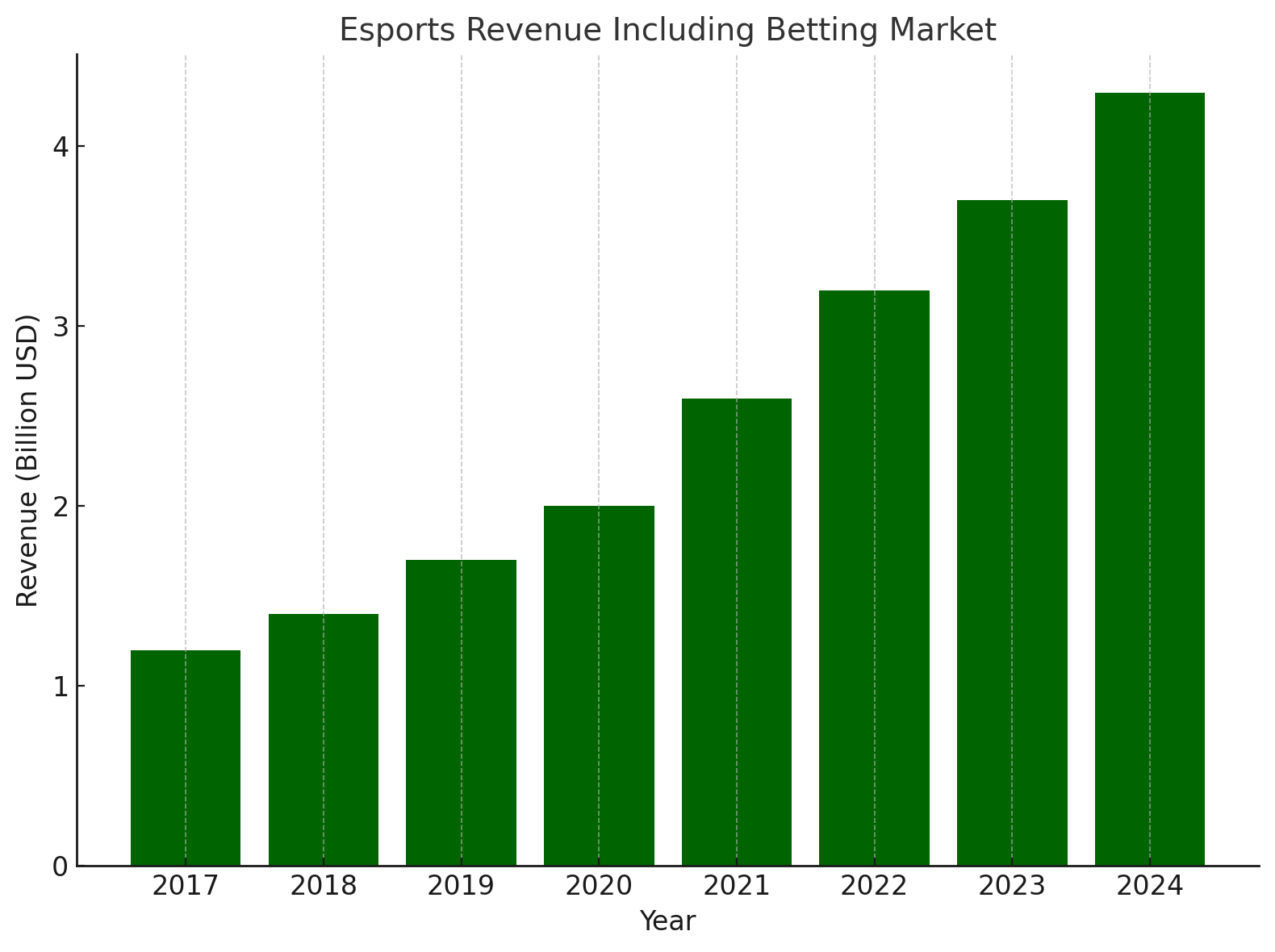

According to Statista, whose analysts have been tracking revenue dynamics with betting since 2017, the industry has already crossed the $1 billion bar for the first time, and by 2024 the investment volume has exceeded $4.3 billion.

Year | Revenue volume (bln) |

|---|---|

2017 | 1.2 |

2018 | 1.4 |

2019 | 1.7 |

2020 | 2.0 |

2021 | 2.6 |

2022 | 3.2 |

2023 | 3.7 |

2024 | 4.3 |

Statista analysts predict that in 2025 the revenue of the cyber sports economy will exceed the mark of 4.8 billion U.S. dollars.

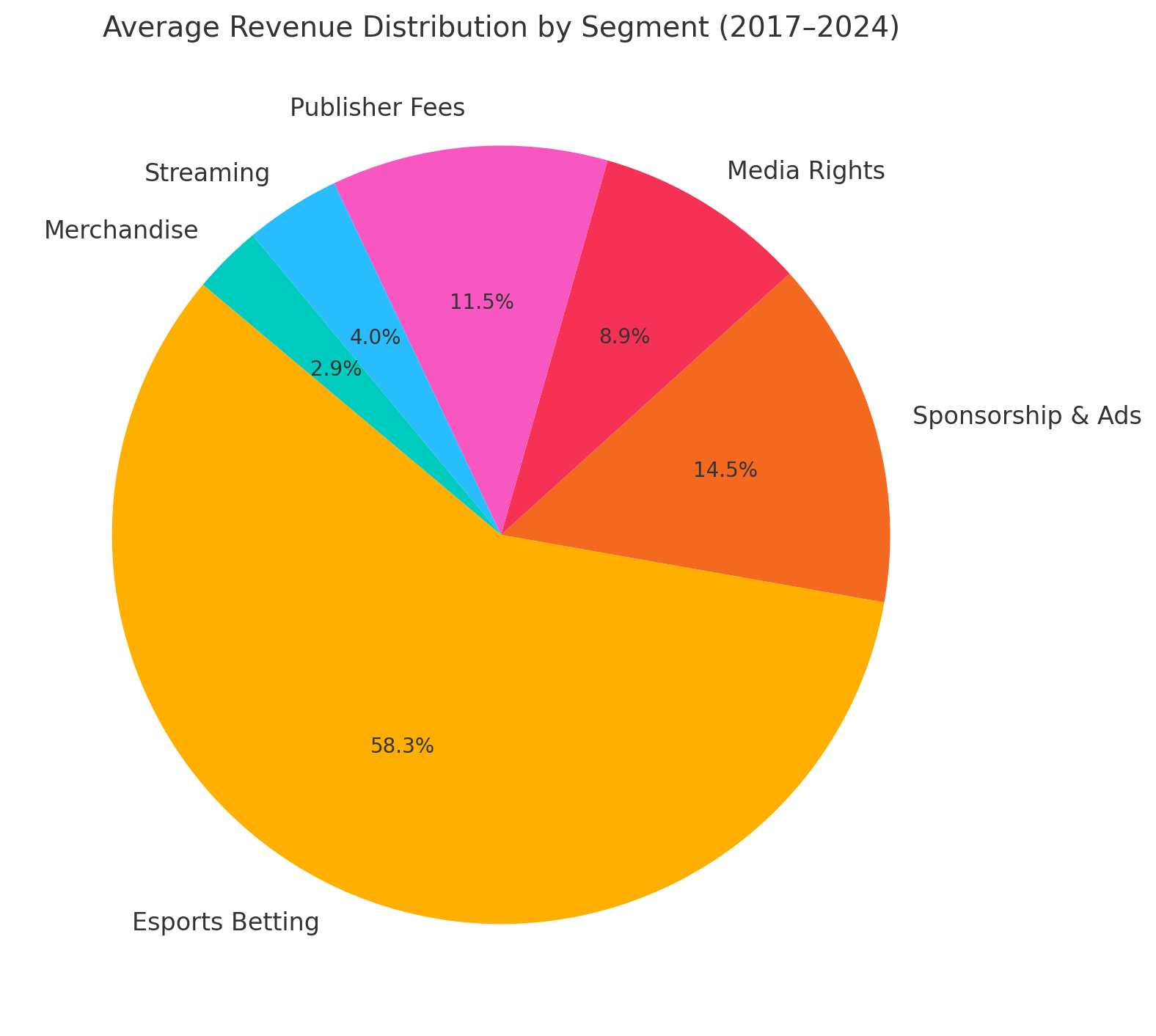

If we average the data on the share of revenue sources of the industry, we can conclude that betting on cyber sports events bring more revenue than other sources in total. Their share exceeds 58% of the total revenue. The second place is occupied by revenues from sponsorship contracts and advertising - 14.5%. Merchandise revenue brings only 2.9% of the industry revenue, and streaming accounts for only 4% of the total revenue.

Interesting fact: “Betting revenue in eSports is already 6 times higher than streaming revenue. That's a red flag for platforms.”

Jordan, Intel and Adidas: why are they investing in gaming?

According to ISPO, Intel has been backing ESL - the largest tournament operator - since the mid-2000s.

Here are some high-profile examples:

Major apparel makers Nike and Adidas also actively support the industry by developing their own cybersports teams. For example, Adidas funds teams such as G2 Esports, 100 Thieves and North.

Sandra Esseshoe (Ott), Communications Manager at Adidas commented on the collaboration with North as follows:

“In general, cybersport has a fantastic community that supports and connects people from different countries...As a sports company, we believe that it is possible to succeed through passion, practice, motivation and support. We want to show the next generation that we see and support what they care about because we know how important communities are to young people.”

PepsiCo and Coca-Cola aren't staying away either. PepsiCo funds Splyce, Team Dignitas and SK Gaming, as well as major CS2 tournaments, while Coca-Cola supports e-NASCAR, Riot Games, Pittsburgh Knights, paiN Gaming and Tespa, has been a partner of the LoL World Championship and Wild Rift, and has helped Riot Games develop LoL cybersports.

Celebrities are also actively investing in cybersports. According to Forbes, the famous basketball player Michael Jordan invested more than 26 million dollars in the cybersports club Team Liquid, buying a stake in aXiomatic. Before that, his colleague Magic Johnson invested his money there as well.

And Ted Leonsis, owner of the Washington Capitals hockey team and co-owner of aXiomatic commented on the investment in Team Liquid as follows:

“Probably no other franchise has the championship pedigree that Michael and Magic and I have.”

Top 5 Biggest Investors in Esports

Investor | Amount ($M) | Year |

|---|---|---|

Michael Jordan | 26 | 2018 |

Intel | ~8.3 | since 2006 |

Coca-Cola | >10 | 2021–2023 |

Adidas | ~5–10 | 2020+ |

PepsiCo | ~5–10 | 2019–2024 |

It's important to realize: no one wants to miss a chance to make money. One Maximize Market Research analyst remarked:

“Whereas in the past you had to explain what cybersport was, now brands are coming to the organizers themselves.”

However, there are some bad cases:

Top 5 most overvalued investments in cybersports

The closing of Microsoft's Mixer streaming platform (losses of more than $25 million).

Overwatch League's purchase of Overwatch League slots for $20 million or more.

FaZe Clan's attempt to go public at an inflated valuation ($725 million - and IPO failure).

Betting on NFT projects from cyber sports teams (many with zero revenue).

Mass sponsorship of Chinese organizations that did not survive until 2023.

Read more about the contribution of brands and stars in our last article.

What will happen to cybersports in the 2030s: $13 billion or the collapse of the bubble?

Analysts at Globe Newswire predict that by 2029, the cybersports economy will reach $5.18-5.5 billion in revenue. If these predictions come true, annual growth will remain at the current level of 5% to 6% per year.

Such growth makes cybersport one of the fastest growing segments not only in entertainment, but also in the global economy as a whole. And by 2032, according to the authors of the publication, the industry will bring in $13.7 billion dollars in revenue.

Statista analysts, who take into account the income from the betting market in their reports, also give forecasts until 2029. They estimate that industry revenues will approach the $6 billion mark by 2029, indicating a trend toward a gradual decline in the share of betting revenues in favor of other sources, primarily sponsorship contracts and partnerships.

The dark side of rapid growth: the cybersports economy bubble

But some experts have misgivings about the development of the field. For example, Frank Fields, cybersports and sponsorship manager at Corsair, expressed concern in an interview with Kotaku that analysts are exaggerating the numbers in their conclusions about the industry.

“It seems to me that cybersports is a pyramid scheme right now,” shares Frank Fields.

Despite the explosive growth of cybersports - both in terms of investment and revenue for players, streamers and tournament organizers - a study of the Chinese market shows that this development is not always sustainable.

In 2024, analysts Xin Li and colleagues identified four periods of financial bubbles in the Chinese cybersports industry (2014-2021). These bubbles occurred due to:

inflated market expectations,

massive inflows of venture capital,

political support without a long-term strategy,

panic and hype during a pandemic.

Each of these periods ended with a sharp price collapse that hurt not only investors but also industry participants themselves: fees were reduced, events were canceled, and companies went out of business.

The researchers state:

“...China's cybersports market is in its infancy, and policies and regulations are still incomplete. To promote the development of China's cyber sports market, the authorities should formulate regulations to support the cyber sports industry, strengthen investment in technological innovation, and improve the talent training system, which is based on the development experience of Korea's cyber sports market...”

Conclusion

Currently, the cybersports economy is going through a booming phase. Although the absolute numbers are still inferior to the revenues of some traditional sports like the NFL or NBA, the growth dynamics suggest an imminent leveling off in a number of items. The experience of recent years shows that the cybersports industry has already become a multi-billion dollar business, attracting investments from major brands. But only time will tell how stable this growth will be. And do you think the cybersports economy will continue its strong growth?

Want to use this material on your blog? Don't forget to include a link!

Useful materials:

Statista: Cybersports Market Report 2024

GlobeNewswire: Forecast for 2029

Kotaku: Interview with Frank Fields